Our Strategies

Thematic, Value-Driven Strategies Designed For Resilience and Outperformance

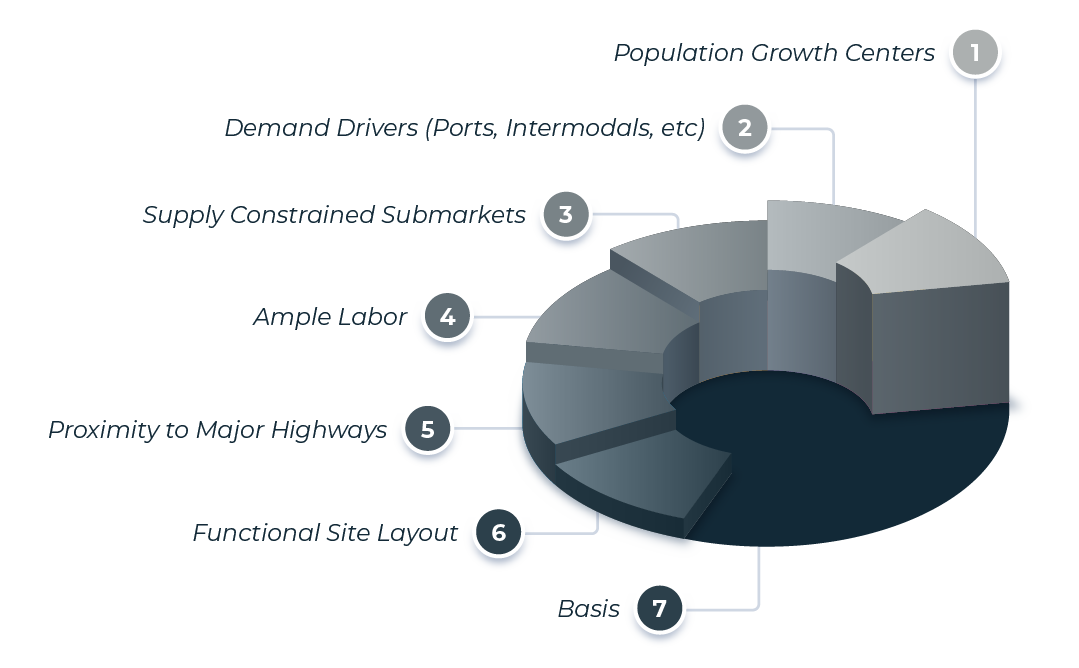

We focus exclusively on industrial real estate in the Sunbelt region, with a core focus of investing in major port markets and regional logistics hubs. We outperform by winning at the local market level first and then bringing our institutional underwriting and operations to bear. Each of our strategies are carefully crafted to maximize our local advantage and optimize according to each macroeconomic cycle.

Our Proven Approach to Investments:

- Hyper Local

- Data Driven

- Granular

- Relational, Never Transactional

Development

Creating value from the ground up:

- Distribution center development in key population centers and logistics hubs

- Designed for maximum flexibility to appeal to the most discerning logistics clients

- Value-engineered for maximum capital efficiency

- Investment Period: 24-36 months

Value-Add Acquisitions

Unlocking Hidden Value:

- Value-creation in assets with a yield premium to core product because of:

- Existing vacancy or near-term lease expirations

- Niche product types (e.g. cold storage, equipment storage, light manufacturing facilities, etc.)

- Secondary market locations

- Smaller transaction sizes

- Built on a disciplined underwriting of conversion / make-ready costs is key

- Cap rate compression achieved through scale and diversification of portfolio

- Investment Period: 36-60 months

InLight Build-To-Core

Crafted for enduring value:

- Core-market speculative development built for long-term investment

- Advantages to core investors over an acquisition-only approach:

- Greater control over their pipeline and portfolio

- Opportunity for 50+ bps stabilized yield premium vs. average yield on competitive stabilized asset acquisitions

- Hold Period: 10+ years

Corporate Client Solutions

Redefining Corporate Real Estate:

- Services:

- Provide dedicated capital and development expertise to fund client real estate projects and preserve client capital for higher return investments in their core business

- Unlock trapped equity in owned real estate by acquiring owned assets via a sale/leaseback transaction

- Acquire well-located excess land and/or assets that are no longer needed for operations without a corresponding leaseback

- Strengths:

- Nationwide corporate build-to-suit and sale-leaseback experience as a developer/buyer

- Expert real estate market knowledge to drive site selection processes, custom-tailored to accommodate client operations and logistical requirements

- Strong relationships with best-in-class Architects, Designers, Engineers, and Contractors to optimize project design and deliver low cost, functionally-efficient space

Our Target Markets

- Atlanta, GA

- Dallas, TX

- Norfolk, VA

- Charleston, SC

- Greenville, SC

- Savannah, GA

- Jacksonville, FL

- Orlando, FL

- Lakeland/Tampa, FL

- Phoenix, AZ

- Nashville, TN